Important information about your HSA investments

Experience more with HSA Invest

There's a new investment program — HSA Invest. This program is designed to streamline your investment experience while it gives you greater options and control.

Read on for important dates, details, FAQs and actions you may need to take. Be sure to check your inbox for updates on the investment program.

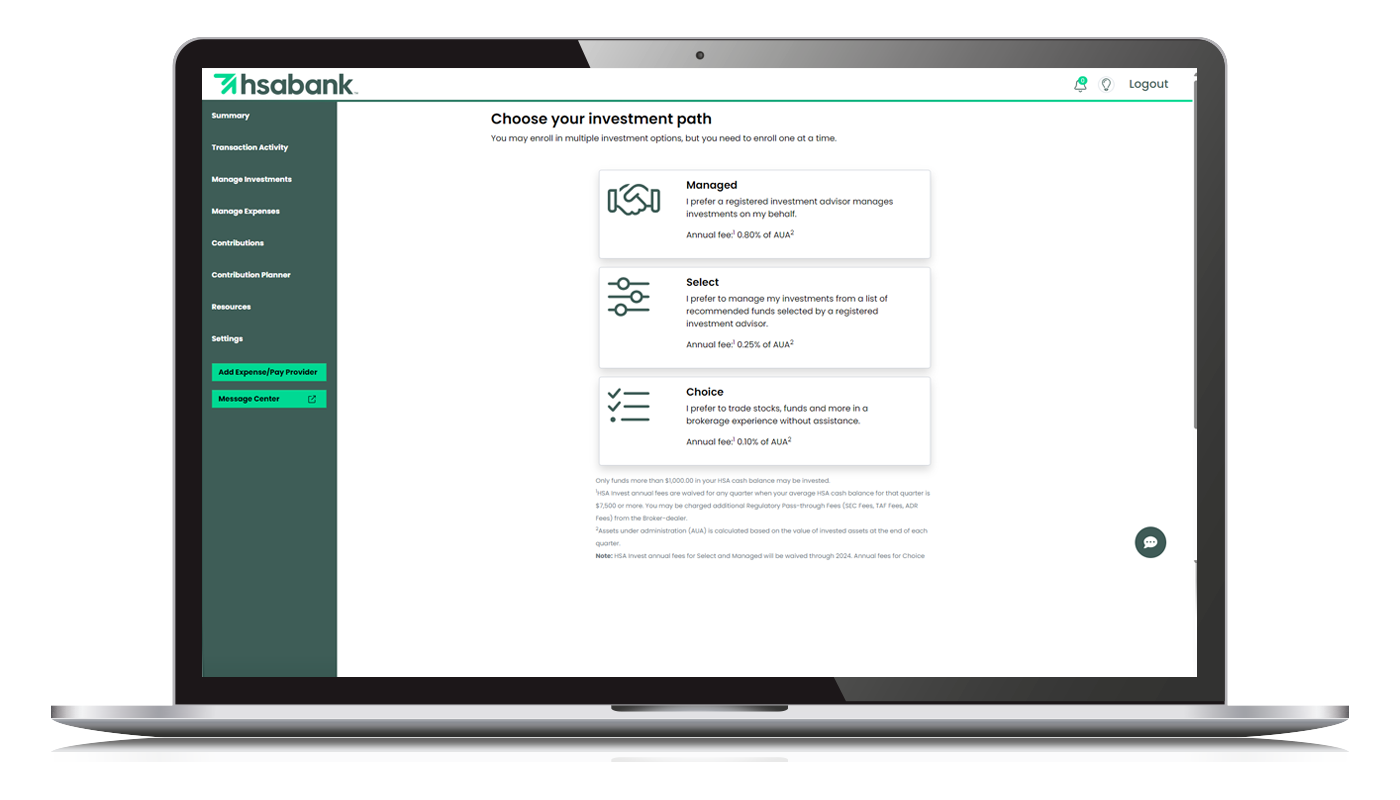

There are three investment options to choose from in the HSA Invest program:

Choice

Get a simplified brokerage experience with a large range of stocks, mutual funds, exchange-traded funds (ETFs) and more. This option is ideal if you're an experienced investor who may not need guidance from a professional.

Select

Get a recommended list of mutual funds, specific to your unique risk tolerance and investment objectives. All funds are selected by a Securities and Exchange Commission (SEC)-registered investment advisor (RIA), organized by asset class, and aligned to your current investment profile. This option gives you guidance and the opportunity to make the final decision about your investments and allocations.

Managed

Get a variety of exchange-traded funds (ETFs) in recommended portfolios. You’ll have the expertise of an RIA who will make trades and manage your investments on your behalf. It’s a hands-off way to invest.

You may have one or all the investment options based on your employer program. Your option(s) will show in your online account.

What’s new with HSA Invest:

Integrated experience

You can fully manage your investments alongside your HSA cash balance from the HSA Bank Member Website and app. You can save, spend and invest on just one site and app without redirects or additional logins!

Immediate action

Same-day enrollment and funding means there's no lag time between buying and selling your investments.

Personalized investment options

Three investment options offer greater personalization and address different risk tolerances and objectives.

Here’s what else:

Your funds stay in your HSA cash balance until you choose to invest. This makes your funds available for qualified medical expenses when you need them.

Once you invest, any dividends and interest are automatically reinvested. This will help grow your balance over time. With our optional auto-investing feature, any new contributions can be seamlessly allocated to funds you’ve already selected helping you stay on track with your investment goals.

Important dates

- March 17: The transfer in kind from Devenir to HSA Invest was completed.

- July 31: The last day to access your view-only Devenir account for historical information.

- June 12, 4 p.m. ET: The last day to take action regarding your transferred investments. You have two options: 1) Complete enrollment in HSA Invest or 2) Liquidate your transferred investments.

- Beginning on or about June 16: Your investments will be liquidated and available in your HSA cash balance if you don’t complete enrollment or liquidate your investments yourself.

Manage investments

Frequently asked questions

General FAQ

1. Log in to your account.

Use your existing username and password. You only need to create a username and password if you haven’t accessed your account online before.

If you access the Member Website from a third-party site, like your employer benefits site or insurance site, access as you normally do.

2. Go to Manage Investments.

3. Begin the HSA Invest enrollment process.

You can access the new investment program in your online account under Manage Investments.

You can still access your existing investments with Devenir and Schwab in your online account under Manage Investments.

Call the number on the back of your HSA Bank debit card for help from HSA Bank Client Assistance Center representatives.

We actively review what we offer you and are pleased to present HSA Invest. This new program offers a seamless investment solution with multiple options. HSA Invest gives you more ways to access and manage the investments in your HSA with a host of enhanced features like:

- Money remains in your HSA cash balance until it’s invested, so it’s available for qualified medical expenses if you need it.

- Dividends and interest are automatically reinvested.

- Same-day enrollment and funding means there’s no lag between buying and selling your investments.

- Better integration of cash balance and investment funds on one site and one app.

- Simplified process to enroll and invest.

You may have been impacted by an investment program change in 2023, which was outside HSA Bank’s control. HSA Bank had a long-standing relationship with TD Ameritrade to provide investment options to accountholders. Then, TD Ameritrade, Inc. was acquired by Charles Schwab. In September 2023, Schwab moved all TD Ameritrade accounts to Schwab, including those of HSA Bank accountholders.

The launch of HSA Invest is the first change initiated by HSA Bank, which happened to be in the same 12 months as the transition from TD Ameritrade to Schwab.

You may be required to keep a minimum in your HSA cash balance to invest. Details are available in your online account under Manage Investments.

The annual fees are 0.10% for Choice, 0.25% for Select and 0.35% for Managed. HSA Invest annual fees for Select and Managed will be waived through 2024. Annual fees for Choice will be waived through 2025.

The fees are assessed on a quarterly basis and deducted from the investment balance. The fee is calculated on a percentage basis on the fair market value (FMV) on the last day of each quarter.

For every $1,000 you invest you’d pay $0.25 quarterly for Choice, $0.62 quarterly for Select and $0.87 quarterly for Managed.

HSA Invest annual fees are waived for any quarter when your average HSA cash balance for that quarter is $7,500 or more.

If your HSA is through your employer, log in to your account for specific fees.

Yes. When you enroll in HSA Invest you can set up automated funding. You can also set up automated funding after enrollment. Log in to your account, go to Manage Investments then Current Holdings to set up automated funding.

Yes. Log in to your account, go to Manage Investments then Current Holdings. Access automated funding settings and update.

Automated funding lets you move HSA funds into your investments and automatically trades according to the allocation you set. Here's what you need to know:

- Timing: Automated investing occurs daily between noon and 2 p.m. CT on market days.

- Deadline: To ensure your funds are moved and traded on the same day, set up automated investing before noon CT.

- Instant, one-time buy versus automated investing: If you prefer immediate trading, go to Available Investments and select Buy. This lets you buy stocks or ETFs instantly during market hours.

View all funds available in your online account or download the list.

This list may change as the investments are continuously monitored by the SEC-registered investment advisor.

The Choice option includes over 6,500 investments including those from American Century Investments, Clearbridge Investments, Dimensional Fund Advisors, Fidelity Investments, Franklin Templeton, Putnam Investments, Royce, Schwab, T. Rowe Price, Vanguard and more.

As of Aug. 15, there are two money market funds: Federated Hermes Government Obligations Fund (GOIXX) and Fidelity Government Money Market Fund (SPAXX).

Download the list of available investments in the Choice option. This list may change as the investments are continuously monitored by the SEC-registered investment advisor.

Yes, as part of the HSA Invest program, dividends are automatically reinvested to help maximize your investment growth. By enrolling in the HSA Invest program, you agree to this automatic dividend reinvestment. There’s no option to opt-out of dividend reinvestment.

All trades placed after 4 p.m. ET will be executed the next business day.

The HSA Invest program is designed to prioritize the stability and growth of your HSA. As such, options trading is not supported, as it doesn't align with the primary goals of an HSA. However, to help you build a well-rounded investment strategy, we offer a range of investment choices including mutual funds, stocks and ETFs. These investments could help you grow your savings over time while maintaining the security and flexibility needed for healthcare expenses.

If you’re already enrolled in one of the investment options within the HSA Invest program (Choice, Select or Managed), log in to your HSA Bank account, go to Settings, then HSA Invest Info. Select add another investment option. Follow the steps to enroll in another investment option within the HSA Invest program.

Managed investment option FAQ

If you select the Managed option, for a fee, you’ll have the expertise of an RIA who will make trades and manage your investments on your behalf. It’s a hands-off way to invest. The Managed option offers a variety of exchange-traded funds (ETFs) in recommended portfolios. The portfolios have passively and actively managed ETFs across all major asset classes and investment styles. This option lets accountholders who want a simpler way to invest do just that.

If you choose the Managed option, you’ll be asked to fill out an HSA-risk tolerance questionnaire to determine your advised risk level and investment objectives. The RIA will then manage a portfolio of exchange-traded funds (ETFs) based on your investment goals, risk tolerance and time horizon.

If you prefer to manage your portfolio yourself, you can enroll in the Choice investment option and/or the Select option for more flexibility to manage your own strategy.

We partnered with LeafHouse Financial Advisors LLC, an RIA with over 15 years of experience managing money and investment strategies. Their team of advisors apply their deep knowledge of the market and asset management to create asset allocation models based on investor goals and risk tolerance.

The Managed investment option has an annual fee of 0.35% (charged quarterly). View more details about fees. This fee covers the RIA who will actively manage, complete market research, and make investment decisions on your behalf.

With the Managed option, your portfolio of investments is based on your risk level and investment time horizon. If either changes, you can adjust your investments to match your revised goals and circumstances by retaking the HSA risk-tolerance questionnaire. Your portfolio also can be rebalanced with subsequent purchases and on a quarterly schedule.

You can monitor your investments in the Manage Investments section of your online account.

Schwab HSBA FAQ

Your Schwab account has transitioned to a sell-only status, meaning you can no longer add new funds or make additional investments within your account. However, you are not required to liquidate or move your existing investments. You can continue to hold your current assets in your Schwab account and sell them if you choose.

Selling all your securities in your Schwab HSBA.

Yes, you can liquidate your Schwab assets and the cash will automatically transfer to your HSA cash balance to trade in the new HSA Invest program.

Log in to your Schwab HSBA and liquidate your securities. When all trades have settled, the cash will automatically transfer to your HSA cash balance. If you self-liquidate, there’s no fee. You may be charged certain account activity fees by Charles Schwab for assistance with liquidation. Please reference the Charles Schwab Pricing Guide for Health Savings Accounts for fees.

You’re able to transfer eligible investments from your Schwab HSBA to HSA Invest Choice without liquidating them.

There’s a $25.00 Schwab transfer out fee. If there are insufficient funds in your Schwab HSBA to cover this fee, you authorize this fee to be deducted from your HSA cash balance. If there is insufficient cash in your HSA cash balance and your Schwab HSBA, you will need to liquidate a Schwab HSBA investment to cover this outstanding fee. Please reference the Charles Schwab Pricing Guide for Health Savings Accounts for fees.

Not all investments in your Schwab HSBA can be transferred. To find out which securities aren’t eligible, review the transfer form or contact HSA Bank. The securities that can’t be transferred will need to be liquidated before submitting your transfer request.

To begin a transfer request:

- Complete the transfer form.

- Review and adhere to all transfer requirements. This includes liquidating investments that can’t be transferred.

- Submit the completed form and your most recent Schwab HSBA statement to HSA Bank.

You may choose to liquidate your securities instead of transferring. View liquidation details.

HSA Invest offers unique benefits when compared to the existing Schwab Health Savings Brokerage Account (HSBA) option.

| HSA Invest | Schwab HSBA | |

| Access to HSA cash balance and investments with one website login, and from one app | Yes | No |

| Funds go from your cash balance to investments in real-time | Yes | No |

| Funds remain in your cash balance until you invest so they’re accessible for qualified medical expenses | Yes | No |

| Streamlined steps to liquidate investments and move funds to your cash balance to use for qualified expenses | Yes | No |

| Access to HSA-appropriate investments selected by an SEC-registered investment advisor | Yes | No |

| Simple interface for beginner and advanced investors | Yes | No |

| Real-time and fractional share trading (during market hours) | Yes | Yes |

| Thousands of investments including stocks, mutual funds and ETFs | Yes | Yes |

Your CD with Schwab can remain sell-only. There's no need to sell your CD.

Yes, dividends continue to be reinvested in existing Schwab HSBA investments since dividend reinvestment isn’t considered an investment buy.

Many, but not all, of the investments in the Schwab Health Savings Brokerage Account (HSBA) program are available in HSA Invest. HSA Invest offers thousands of investments including mutual funds, stocks, and ETFs that can help you grow your savings over time while maintaining the security and flexibility needed for healthcare expenses.

These investment types aren’t available in HSA Invest:

|

|

|

Some investments in the below categories aren’t available in HSA Invest. If you have holdings in one of these investment categories call the number on the back of your card or review the list of unavailable investments to find out if your specific holding is impacted.

|

|

|

Any Schwab HSBA holdings that aren’t offered in HSA Invest can’t be transferred to the HSA Invest program.

You can choose to liquidate these investments or keep them in sell-only status. Liquidating these investments allows you to purchase new similar investments and set up automated investment funding in HSA Invest.

If you have liquid balances from dividends or sales in your Schwab account, these will be transferred to your HSA cash balance twice per week, making it easier for you to reinvest through HSA Invest. You'll see the cash credited to your account on Tuesdays and Fridays. If you chose to have your dividends reinvested, they will continue to be reinvested in your Schwab account as usual.

Yes, HSA Bank will notify Schwab HSBA investors if and when you will be required to liquidate or transfer your eligible investments to HSA Invest Choice.

Devenir and transfer-in-kind FAQ

You have two options to avoid forced liquidation:

- Complete enrollment in the HSA Invest program. You need to enroll in a specific option (either Select or Choice) based on where your Devenir investments were transferred. Log in to your account and go to Manage Investments to see which option you need to enroll in.

- You may choose to liquidate your investments that transferred from Devenir to HSA Invest. The funds will then be available in your HSA cash balance.

You must act by June 12, 4 p.m. ET. If you do nothing, beginning on or about June 16, HSA Bank will liquidate the investments that transferred from Devenir to HSA Invest. The funds will then be available in your HSA cash balance.

If you do not take action by June 12, 4 p.m. ET, then beginning on or about June 16, HSA Bank will liquidate the investments that transferred from Devenir to HSA Invest. The funds will then be available in your HSA cash balance.

- Log in to your account. You’ll be prompted to complete enrollment.

- Go to Complete Enrollment and follow the steps provided.

After login, you can also:

- Go to Manage Investments.

- Go to Complete Enrollment on the indicated investment option.

- Complete enrollment steps.

During the enrollment process you’ll agree to terms and conditions and other regulatory documents. You’ll also see the annual fee for the investment program.

- Log in to your account. You’ll be prompted to complete enrollment or liquidate.

- Choose Liquidate.

- Follow the steps provided.

The liquidation only impacts mutual funds that transferred from Devenir as part of the transfer in kind. If you have other HSA investments, they’re not impacted because you already accepted the necessary terms and conditions for those investments.

HSA earnings, including capital gains/losses from liquidations, aren’t subject to federal taxes and aren’t subject to state taxes in most states. The specific tax treatment may vary by state so please consult a tax advisor for details.

There may be Securities and Exchange Commission (SEC) fees like redemption fees associated with liquidating your investments. If the mutual fund imposes a redemption fee, you’ll have to pay that fee in accordance with the terms of the mutual fund prospectus.

There’s no closing fee for liquidating your investments.

The liquidation of investments, if applicable, will be conducted by LeafHouse Financial Advisors, LLC (LeafHouse), an SEC-registered investment advisor, at the direction of HSA Bank pursuant to the HSA Custodial Agreement. Refer to LeafHouse’s Form ADV Part 2 and Form CRS in your online account for more information about the firm.

The HSA Custodial Agreement is available in your online account at the bottom of every page.

Your funds will be available in your HSA cash balance 1 business day after you initiate the liquidation. Weekends or holidays may delay fund availability.

Your funds will be available in your HSA cash balance 1 business day after the liquidation is initiated. Weekends or holidays may delay fund availability. Liquidation will begin on or about June 16.

Your fees in the HSA Invest program may be either equal or potentially lower than with Devenir. View HSA Invest fee details.

The Select option is the most like the Devenir program, which you previously enrolled in. Like Devenir, the program has a defined list of mutual funds that were selected by an SEC-registered investment advisor.

When you enroll in the HSA Invest Select option, you’ll be prompted to complete a risk tolerance questionnaire. You’ll then be presented with a recommended asset allocation based on your responses. You can choose to enroll in the recommended funds and set up automated investment funding. Your investments are now set up.

If you had investments with Devenir, they’ll also be available to view as sell-only after the transfer-in-kind. No new purchases of those funds can be made. To no longer hold sell-only investments, you can liquidate those assets and invest the proceeds in your new recommended fund lineup.

During the transfer-in-kind, your Devenir assets were transferred to the Select option within the HSA Invest program. If you’d prefer to invest in the Choice option, you can:

Keep the Devenir investments that transferred to the Select option as sell-only and open a second investment option, Choice. View fee details.

Liquidate the Devenir investments that transferred to the Select option. You can then close the Select option and enroll in the Choice option. Then invest funds in the Choice option.

Your investments must be liquidated before closing an investment option. Once liquidated, log in to your HSA Bank account, go to Manage Investments, select your investment account, then Preferences. Select Close Investment Option and follow the prompts.

You will have view-only access to your account through July 31, 2025. Save information that you want to retain from your account before this date.

HSA Bank opened an account on your behalf to transfer the mutual funds. You will need to agree to the terms and conditions and other regulatory documents to complete enrollment and access investments after they transfer.

The Select option is most like the Devenir program, which you previously enrolled in. Like Devenir, the program has a defined list of mutual funds that were selected by an SEC-registered investment advisor. You may request to transfer your mutual funds after the transfer is complete to the HSA Invest Choice option.

No. Since the assets aren't sold, a transfer in kind does not trigger capital gains taxes. Please consult with a tax advisor for additional information regarding potential tax implications.

SECURITIES AND INVESTMENTS

|

Not Insured by FDIC or Any Other Government Agency |

Not Bank Guaranteed |

Not Bank Deposits or Obligations |

May Lose Value |

Schwab Health Savings Brokerage Account (HSBA) is offered through Charles Schwab & Co., Inc. (Member SIPC), a registered broker dealer, which also provides other brokerage and custody services to its customers. Devenir Mutual Fund Selection Option is provided by Devenir Investment Advisors, LLC, a registered investment advisor that selects and monitors the performance of the mutual fund lineup. The HSA Invest program is administered by DriveWealth, LLC, a FINRA registered broker dealer. LeafHouse Financial Advisors, LLC is a registered investment advisor with the U.S. Securities and Exchange Commission that offers investment advisory and management services. Registration does not imply a certain level of skill or training. More information about LeafHouse Financial Advisors, LLC, including investment strategies, fees and objectives, can be found in its Form ADV Part 2 and Form CRS, which are available on the Member Website.

HSA Bank, Charles Schwab & Co., Inc., Devenir Investment Advisors, LLC, DriveWealth, LLC and LeafHouse Financial Advisors, LLC are not affiliated and not responsible for the products and services provided by the other. Neither HSA Bank, Devenir nor DriveWealth can provide investment advice to investors. Past performance is not indicative of future results. All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. The ability to replace investment losses may be limited by the annual HSA contribution limits.